Bush Brothers had reached a crossroads in the early 1990s. Founded by A.J. Bush in 1908, the family-owned vegetable canning company based in Knoxville, Tenn., was experiencing succession challenges and ready for a change in strategy.

Many of the second-generation family members had died, and it was time to pass along ownership to the third generation. The steps Bush Brothers took to survive and thrive can provide a road map for leaders of family-owned businesses eager to see the companies they have built carry on for multiple future generations.

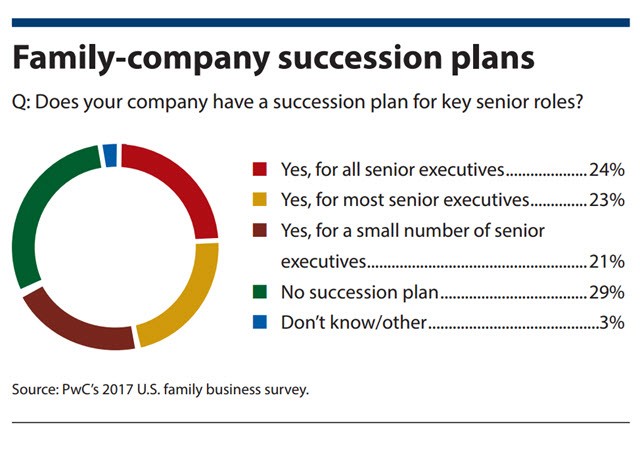

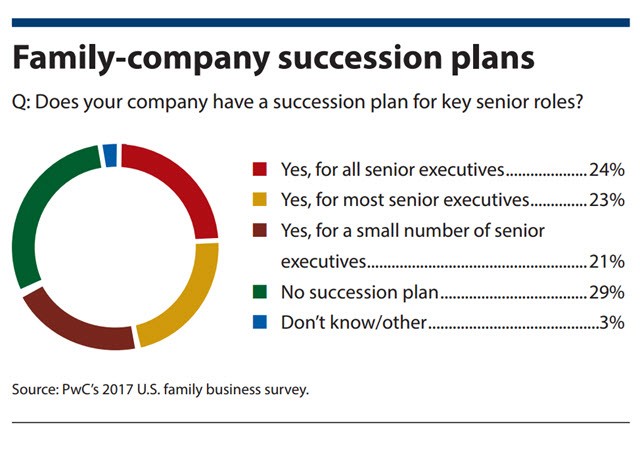

Family-owned businesses often struggle with strategic planning, beyond establishing yearly budgets. Less than half (45%) of family businesses participating in PwC’s 2017 U.S. family business survey said they have a strategy fit for the digital age. Meanwhile, just 23% of family companies participating in the survey have a robust, documented succession plan in place, and 46% of family business leaders said they are reluctant to pass on leadership to the next generation.

Read More

It shouldn’t be a surprise that planning for strategy and succession is one of the biggest problems encountered by family businesses. Jonathan Flack, CPA, PwC’s U.S. family business services leader, said first-generation family business founders often have succeeded because they trusted their instincts and decisions. That belief in their own abilities can cause them to resist the multiple points of view required for a comprehensive strategic-planning process, and it may cause reluctance to plan for the time when they will have to turn over the leadership to others.

“There are some difficult topics that need to be addressed,” said Alfred Peguero, CPA, the U.S. family business survey leader for PwC. “But just like the calendar and the clock, they keep moving forward, and these folks have to address them. Hopefully in a timely manner so it’s not pushed upon them that the patriarch or matriarch passes away sitting at the desk with everything around them and a bunch of unsigned checks.”

CPAs advising family business owners—and CPAs who serve in finance and other capacities at family businesses—may have opportunities to nudge leadership toward planning for strategy and succession that can address these shortcomings and lead to a more successful, sustainable business.

AVOIDING TUNNEL VISION

Flack suggests that a strategic-planning process for a family-owned business should include a careful discussion and evaluation of:

- The changing landscape of the current business environment.

- Changes in consumer habits and needs.

- The products and services that they currently offer.

- Capabilities they possess that may be underutilized.

Family-owned businesses tend to get tunnel vision about their products and services and may not take time to step back and evaluate the real strengths and capabilities they have developed, Flack said. The PwC survey showed that 87% of family businesses expect to achieve revenue growth over the next five years by doing what they’re already good at, and just 21% of family companies rank “being more innovative” as a very important business goal. Family businesses typically prepare budgets a year or two ahead of time, and they may evaluate potential investments and acquisitions, so they are thinking about some of the elements that are involved in strategic planning, Flack said.

“But we don’t actually see them going through a full process of the strategic plan,” he said. “… It comes down to them not seeing the value in going through that process, and really the long-term benefits of regularly performing that strategic planning.”

While failure to plan strategically can result in lost business opportunities, neglecting succession planning can cause a family-owned business to suffer either sudden interruption upon the unexpected death of a key leader, or a more gradual loss of the talent needed to sustain success. Problems with commingling of family and business resources, cash flow, equity, and debt can complicate succession planning in family businesses. Succession issues can be particularly challenging when multiple family members share ownership and responsibilities for the business without parameters that are clearly written out. If one cousin contributed most of the seed capital for the company, the second provided the big ideas that the company incorporated to succeed, and a third ran the operations successfully for 40 years, finding an equitable way for the next generation to continue the business may be difficult if succession hasn’t been mapped out well in advance.

It’s not as though most family-owned businesses don’t think about succession at all. More than two-thirds (68%) have a succession plan in place for at least some senior roles (see the graphic, “Family-Company Succession Plans”), and just 29% have no succession plan at all, according to the PwC survey. But in many cases, the succession plan is not fully developed or sustained over time, so it does not provide the security the business needs.

GOOD GOVERNANCE

About 25 years ago, Bush Brothers found itself without the security and direction needed as control of the family business transferred from the second generation to the third. Some of the third-generation family members were qualified to take on leadership roles, and the whole family began to recognize that it was time to build a governance structure that would formalize both the transition of leadership in the business and the strategic decisions that were made.

They established a board of directors for the business that consisted of five voting members from outside the family and four family members with voting privileges. Today, the board is composed of five nonfamily independent directors, an additional nonfamily CEO, three family members with voting rights, and two family members who participate in advisory capacities, but without formal voting rights. One of the first projects the business undertook following this transition was a formal strategic-planning process, an exercise it repeats every five years.

Bush’s originated as a family tomato cannery. In the early 1990s, canned beans had become the company’s staple, but Bush’s still was operating as a regional cannery. The organization’s leaders saw an opportunity to do something different—and more ambitious. They set a course to become a national brand presence and expand their distribution nationally. They decided to dedicate themselves to their most successful product line—baked beans—and make a commitment to be great at producing, marketing, and distributing to consumers across the country.

Founder A.J. Bush (right, in this family photo) started the company in 1908 after buying out the interest of his partners in a tomato cannery. (Photo courtesy of Bush’s)

Jay Bush, great-grandson of the company’s founder, became the brand ambassador and appeared in national advertisements with his golden retriever, Duke. The secret family baked beans recipe developed in 1969 proved to be popular with consumers and was a good advertising hook that helped sales grow quickly. Between 1994 and 2002, the company’s shipments doubled, according to the company.

“I think the focus really helped,” said Drew Everett, a fourth-generation family member who is chairman of the board. “We felt like we could be really good at one thing and be a leader in the marketplace. And we identified that one thing and really focused our efforts on that.”

The success increased the company’s devotion to the type of governance needed to achieve results strategically and pass along leadership to future generations. The family members who were fiduciary and advisory members of the board of directors communicated with and represented their branches of the family. But another board—known as the family senate or council—also was formed to provide family input to the board of directors. A third family-governance entity was formed as a private trust company to help the family manage estate- and wealth-planning activities, although it is not involved in the company’s business operations.

Clear guidelines have been established for membership on the board of directors and the family senate, and similar rules are being developed for the private trust company. The multiple layers of governance helped the organization set parameters for family members to become involved in the business (see the sidebar, “Keeping the Family Involved”) and formalized the process for family members to divest if they choose. It may be difficult for first-generation business owners to see the purpose in this level of governance because they may believe that the bureaucracy slows the speed to market that can make a business effective. But the trade-off that proper governance can provide is a systematic approach to risks and opportunities that considers multiple viewpoints and establishes a clear direction for the future.

“Families are forced to have those other points of view because they share ownership with other family members,” Flack said. “… There has to be a structure and processes so they can have effective ways to work through the decision-making process.”

With the appropriate decision-making structure in place, a family-owned business can focus on strategic initiatives that are in everyone’s best interests. PwC’s survey report suggests that for effective strategic planning, family-owned companies should:

- Focus on goals, not tactics. A strategic plan establishes the company’s goals and direction, while a business plan lays out the tactics needed to pursue the goals.

- Invite input. People are more motivated to achieve goals that they helped create.

- Be prepared for change. After examining the goals for the future and the present situation, you will create a business plan to execute the strategic plan. And you may discover that different approaches are needed to roles and the way the business operates.

- Set a timeline and assign responsibilities. Although the CEO and board own the plan, other managers will drive specific elements of it, and they will need resources to accomplish objectives.

- Measure and adapt. Key performance indicators help in evaluating progress.

- Communicate. Share both the plan and the progress you are making toward accomplishing it. This can help build momentum toward your goals.

GETTING HELP

Everett advises that family-owned businesses consult experts, when necessary, to assist them as they strive to build their plans for strategy and succession. In the 1990s, family members associated with Bush Brothers sought that kind of help as they created the company board of directors and the strategic plan that vaulted them toward national prominence. After that, they tried to build a family council without expert help—and the effort failed. Later, they sought help as they formed both the family senate and the private trust company that are operating today. CPAs can play an important role for family-owned organizations as they attempt to create a successful structure.

“There are a lot of people who can help you,” Everett said.

Bush Brothers also has found that strategic planning and succession planning never truly end. A successful company always is looking for the next talented leaders to emerge, and eyeing opportunities to develop them for high-profile roles. With the company’s governance structure in place, Everett is confident that the right people will be able to implement this and future strategies for years to come.

Meanwhile, Bush Brothers has seen its strategy evolve, with its most successful introduction ever (Bush’s Grillin’ Beans) in 2008 on the company’s 100th anniversary and, more recently, its launch of a line of Latin-inspired beans. The latest strategic plan, completed in 2016, calls for the company to broaden how it thinks about bean-based food and deliver bean-based products to a larger group of consumers in a number of ways. This will include hummus products and crunchy, salty, roasted bean snacks that will be consumed like nuts. In building this plan, company leaders noted that consumers’ focus on health and wellness should work in Bush Brothers’ favor as they work with a vegetable that is high in protein and low in fat.

The company’s continued innovation has included adding multiple flavors (such as homestyle, vegetarian, and bold and spicy) and completing a $100 million expansion of its Chestnut Hill, Tenn., production facility in the early 2000s. And Bush’s has overwhelmingly become the baked beans market leader in the United States, with a market share in the baked beans category of 87.2%, according to the company employee publication, which quotes Nielsen’s Total US All-Outlet research for the 52 weeks ending July 30, 2016. The appropriate governance, strategic planning, and succession planning have provided the environment for that success for a family company that started very small.

“It probably occurs at different times for different businesses,” Everett said. “[But] you have to recognize at some point the complexity of your business, the size of your business, the future opportunities. And there’s a need to look beyond the day-to-day or the tactical.”

Keeping the family involved

Bush Brothers designed an employment policy to create fair opportunities.

For many years, members of the family that owns Bush Brothers were encouraged to work or gain experience elsewhere. Leaders of the company were concerned that it could be difficult to avoid perceptions of favoritism toward family members that would discourage nonfamily members who work for Bush Brothers.

At the same time, though, family members were concerned that qualified members of the family were being overlooked for positions in which they could help the business. After all, who could possibly be more motivated to do a good job for the company than someone in the family with an ownership stake?

This is the type of project the company’s family senate takes on. The senate advises Bush Brothers’ board of directors on various items of interest to the business. In this case, with a number of family members in high school and college, the family senate undertook a project to develop opportunities for family employment without creating an environment that would favor family members over nonfamily employees.

The family senate sought parameters that would be fair to everyone in the company’s workforce. It took guidance from letters and speeches of past company leaders and worked with the human resources department to incorporate processes for recruiting, onboarding, and development that were as consistent as possible with those that exist for employees from outside the family.

“It’s really just making sure we’ve got people here for the right reasons and we can support the development of family members and nonfamily employees,” said Drew Everett, chairman of the board for Bush Brothers.

Meanwhile, the family senate, the board of directors, and a private trust company for wealth and estate management give family members additional opportunities to contribute, without being Bush Brothers employees.